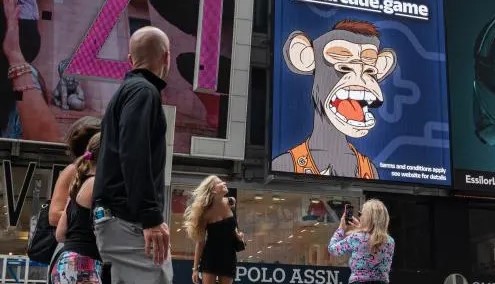

Indeed the most prominent collections are floundering to maintain demand’ Just a couple of times ago you’d have no trouble chancing some celebrity peddling anon-fungible commemorative( NFT) design.

But how snappily times change, as now, indeed websites devoted to gambling with cryptocurrency are advising people to stay down from NFTs.

For those who do not recall, NFTs are entries on a blockchain, generally the Ethereum blockchain, that represent power of means – generally a digital asset like an image train or in- game item, but NFTs could also be tied to physical particulars.

Back in their 2021- 22 florescence, collectors were paying millions for NFTs, but crypto gambling website dappGambl now says that utmost are empty.

After looking at 73,257 NFT collections (a collection can contain any number of NFTs that can each be bought and vended) grounded on data from CoinMarketCap and NFTScan, dappGambl said it determined that 69,795 of those collections have a request cap of 0 Ether

“This statistic effectively means that 95 percent of people holding NFT collections are currently holding onto worthless investments,” dappGambl said in its report. “Having looked into those figures, we would estimate that 95 percent to include over 23 million people whose investments are now worthless.”

Gigantic force, meet shrinking demand While millions may be out the value of their NFT purchase, there are still a ton of NFTs that have gone unsold, which is a problem too.

According to dappGambl’s analysis, only 21 percent of the NFT collections it examined were completely spoken for, which it said eventually means four out of every five NFTs remain unsold.

” It’s a stark memorial that, while the NFT space has introduced a revolutionary new model for power and the monetization of digital means, it remains a largely academic and unpredictable request,” the experimenters said.

Gigantic force, meet shrinking demand While millions may be out the value of their NFT purchase, there are still a ton of NFTs that have gone unsold, which is a problem too.

According to dappGambl’s analysis, only 21 percent of the NFT collections it examined were completely spoken for, which it said eventually means four out of every five NFTs remain unsold.

” It’s a stark memorial that, while the NFT space has introduced a revolutionary new model for power and the monetization of digital means, it remains a largely academic and unpredictable request,” the experimenters said.

Value, too, remains an issue, dappGambl set up. Eighteen percent of the top NFT collections linked by CoinMarketCap have a bottom price of zero,” indicating that a significant portion of indeed the most prominent collections are floundering to maintain demand,” dappGambl said.

Also, 41 percent of NFTs are priced between$ 5 and$ 100, and lower than 1 percent are valued above$ 6,000, all of which points to genuine value in the NFT request being hard to find, said dappGambl. That, in turn, led experimenters to conclude that the situation could be indeed more bleak than the data suggests.

One design, said the experimenters, had a bottom price of further than$ 13 million, but all- time deals of just$ 18.” It becomes clear that a significant portion of the NFT request is characterized by academic and hopeful pricing strategies that are far removed from the factual trading history of these means,” dappGambl said.

In other words, the bottom on the NFT request has well and truly fallen out. Meanwhile, NFT generators keep burning that carbon Cryptocurrencies and their blockchain- conterminous NFT neighbors bear computers, and computers bearpower.

However, they’d better be worth the power being used to produce them and power their blockchains, but that does not appear to be the case – especially as the NFT request defeats, If we are going to burn all this energy on cryptocurrencies and NFTs.

NFTs, being registered on a blockchain and not booby-trapped mathematically like currencies, do not expend energy in the same way, but are still responsible for a lot of carbon being revealed into the atmosphere to mint them onto blockchains and power their uninterrupted actuality.

In addition to the 73,000 collections of NFTs that dappGambl examined for its report, it linked an fresh 195,699 NFT collections” with no apparent possessors or request share.”

The energy needed to mint the NFTs included in those collections, dappGambl claims, is original to kWh of energy, or roughly 16,243 metric tons of CO2 numbers for the energy cost to mint a single NFT are extensively available online.

dappGambl said that equates to the monthly energy emigrations of 2,048 US homes, 3,531 US motorcars, or 4,061 passengers flying from London, UK, to Wellington, NZ, all being burned to produce NFT collections that no one buys.

The result proposed by dappGambl is to only mint NFTs with mileage, like in- game means, token-gated access to events, or links to physical products. Or – bear with me then – we can decide this entire NFT failure was a bad idea that did not actually produce anything of value. That is what the figures suggest, after all.