The entire market is bracing for similar steps by competitor suppliers to prevent future local shortages as sellers strive to fill the 10 million metric ton gap left by New Delhi, escalating fears over already high export food prices.

Analysts believe India’s latest limits are nearly comparable to those imposed in 2007 and 2008, which produced a domino effect in which several other nations were forced to limit exports to protect domestic consumers.

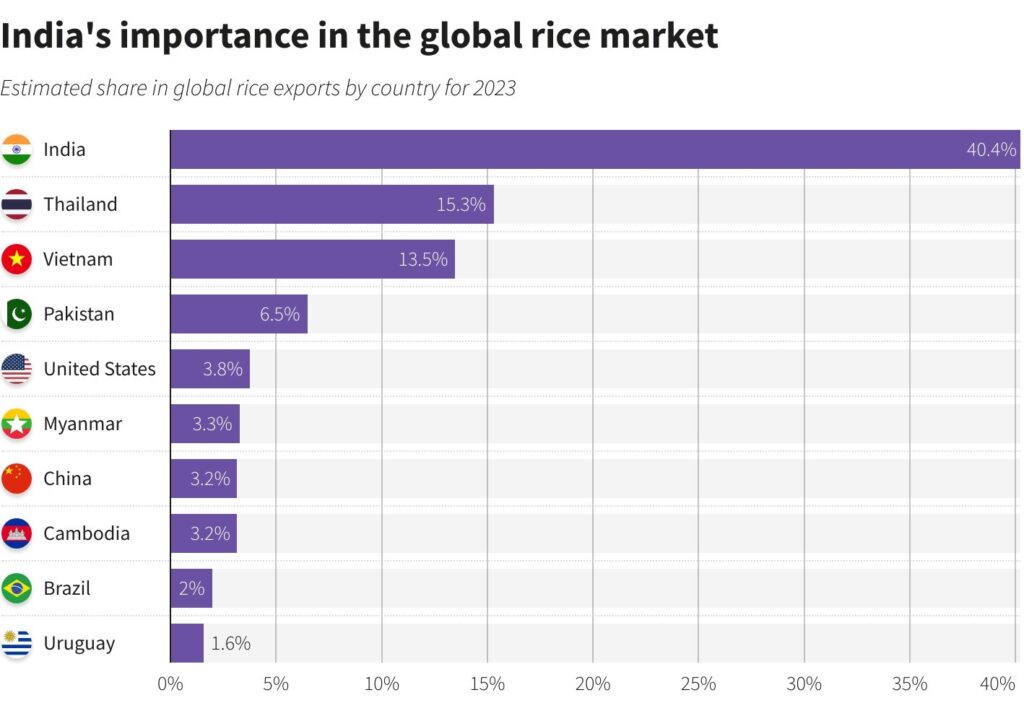

This time, the impact on supplies and pricing could be much more dramatic, as India now accounts for more than 40% of global rice trade, up from roughly 22% 15 years ago, putting pressure on rice exporting countries like Thailand and Vietnam to follow suit.

“India is now significantly more important in the rice trade than it was in 2007 and 2008.” The Indian prohibition at the time compelled other exporters to impose similar restrictions, creating a domino effect.

Even now, they have few options except to react to market pressures,” a grains trader with a global trade business in New Delhi said on the condition of anonymity.

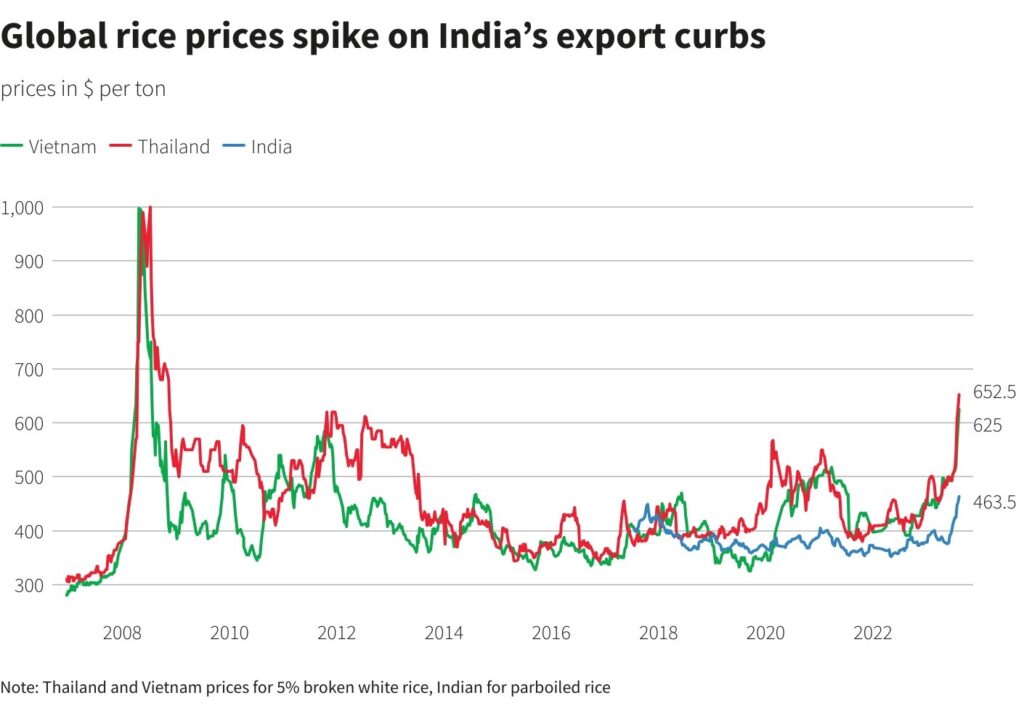

After India startled buyers last month by placing a ban on widely used non-basmati white rice sales to temper price surges, the impact on prices of the world’s most consumed staple was quick, reaching 15-year highs. In 2022, New Delhi has already prohibited lower quality broken rice supplies.

According to researchers and merchants, limited supplies provide a risk of significant increases in rice prices and global food inflation, affecting impoverished customers in Asia and Africa.

Food importers are already dealing with shortages caused by inclement weather and difficulties in Black Sea shipping.

“Thailand, Vietnam, and other exporting countries are poised to step up their game, all in a bid to bridge the gap stemming from India’s shortfall,” said Nitin Gupta, senior vice president of Olam Agri India, one of the world’s top rice exporters.

“However, there exists a constraint in their surplus capacity for exports. This constraint could set the stage for a surge in prices at other origins, reminiscent of the notable price rally we witnessed in 2007/08.”

Rice prices hit a record high of more than $1,000 a ton in 2008, as exports were restricted by India, Vietnam, Bangladesh, Egypt, Brazil, and other small producers.

LIMITED SURPLUS

This time, rice exporters will be unable to expand exports by more than 3 million metric tonnes per year as they struggle to meet domestic demand with a limited excess, according to three dealers with global trade companies.

Thailand, Vietnam, and Pakistan, the world’s second, third, and fourth largest exporters, have claimed they want to increase sales because demand for their crops has increased since India’s prohibition.

Thailand and Vietnam both stated that increased exports will not harm their domestic consumers.

“It’s unacceptable for a rice-exporting country to face tight supplies and high domestic prices,” Vietnam Minister of Industry and Trade Nguyen Hong Dien said last week.

According to an official with the Rice Exporters Association of Pakistan (REAP), Pakistan, which is recovering from last year’s terrible floods, might export 4.5 million to 5.0 million tons, up from 3.6 million tons this year.

However, given double-digit inflation, the country is unlikely to sanction unlimited overseas sales, according to the official.

The Philippines, China, Senegal, Nigeria, South Africa, Malaysia, Cote d’Ivoire, and Bangladesh are the top importers of non-basmati rice.

CHAIN REACTION

Since India’s ban, global prices have climbed by roughly 20%. According to dealers at international trading firms, an additional 15% gain could prompt Thailand and Vietnam to impose limitations.

“The question is not whether they will limit exports, but how much they will limit and when they will take such measures,” a dealer in New Delhi said.

Rice prices in Thailand and Vietnam reached 15-year highs this week as buyers scrambled to cover shipments to compensate for India’s overseas sales decrease.