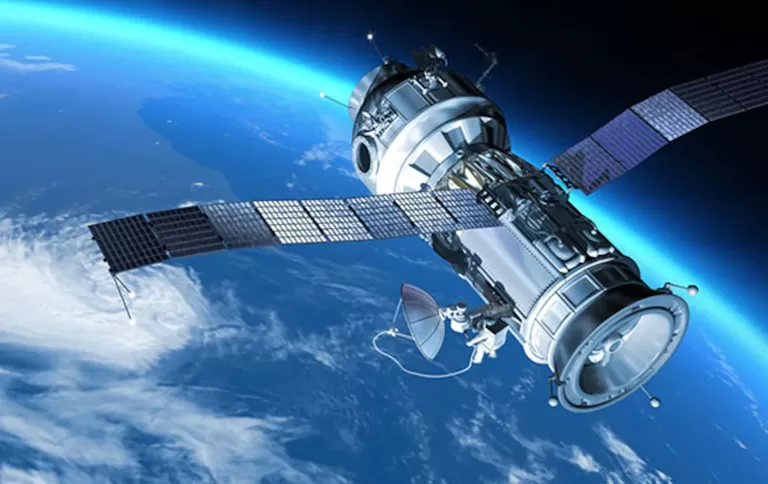

UPI will be available for use by Indian visitors to these two nations, as well as by Mauritanian travelers to India, for making payments.

The latest nations to accept the Indian digital payment system are Mauritius and Sri Lanka, which did so a week after the Unified Payments Interface (UPI) was introduced in France.

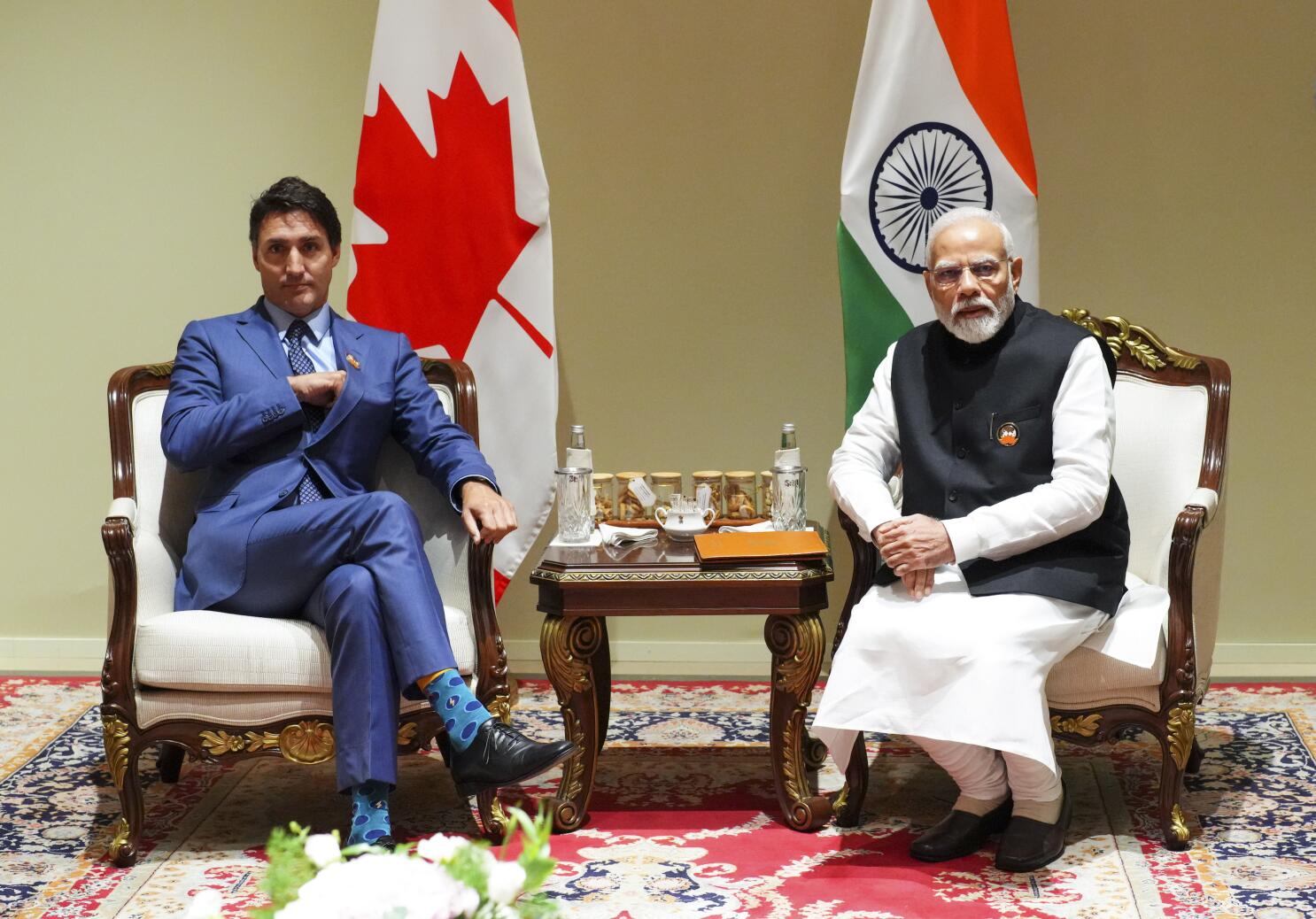

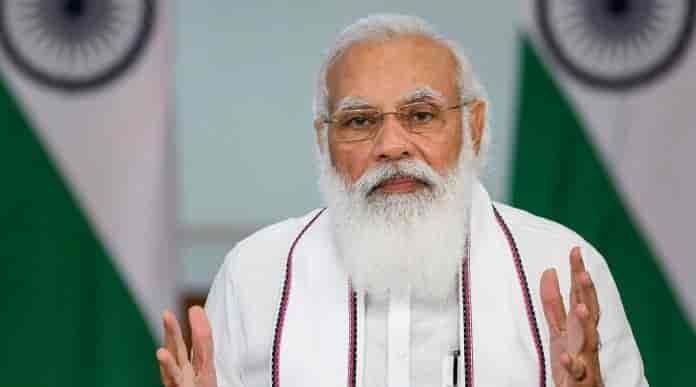

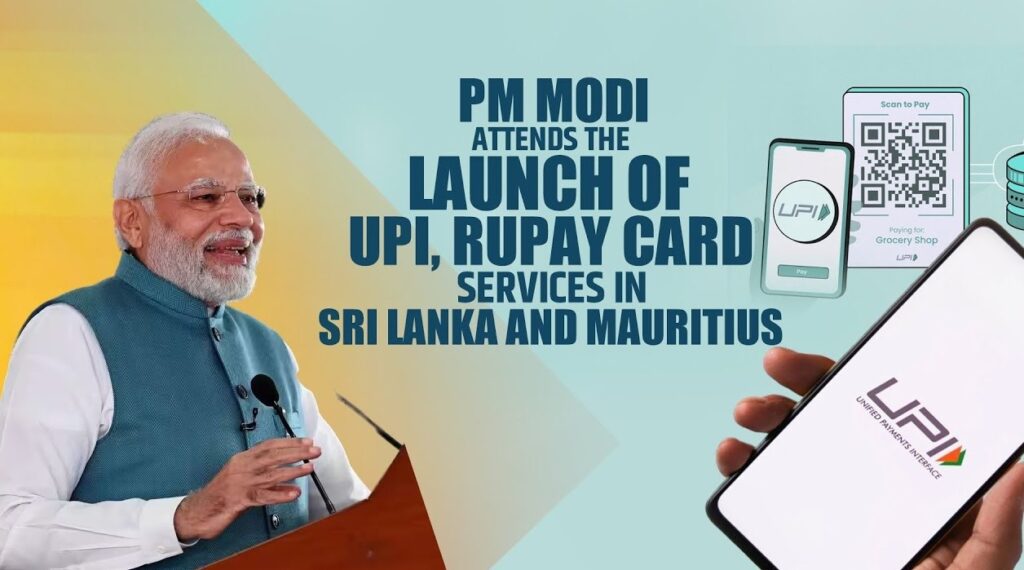

In a virtual presence, Prime Minister Narendra Modi observed the launch event alongside President Ranil Wickremesinghe of Sri Lanka and his colleague Pravind Jugnauth of Mauritius. Today, RuPay cards were also launched in Mauritius.

“Given India’s robust cultural and people-to-people linkages with Sri Lanka and Mauritius, the launch will benefit a wide cross-section of people through a faster and seamless digital transaction experience and enhance digital connectivity between the countries,” said his office.

Also read: Withdraw money from an ATM using UPI

UPI will be available for use by Indian visitors to these two nations, as well as by Mauritanian travelers to India, for making payments. Mauritian banks will be able to issue RuPay cards and utilize them for settlements in both India and Mauritius as a result of the expansion of RuPay services.

“Digital public infrastructure and Fintech innovation have seen India rise to prominence. The administration has stated that the prime minister has placed a high priority on sharing our innovations and development experiences with partner nations.

The administration had described PM Modi’s “vision of taking UPI global” as include the February 2 Republic Day reception at the Eiffel Tower in Paris, where UPI was introduced.

In India, a mobile-based payment system called UPI enables 24-hour payments using a virtual payment address. It unifies different financial functions into a single app and powers numerous bank accounts.