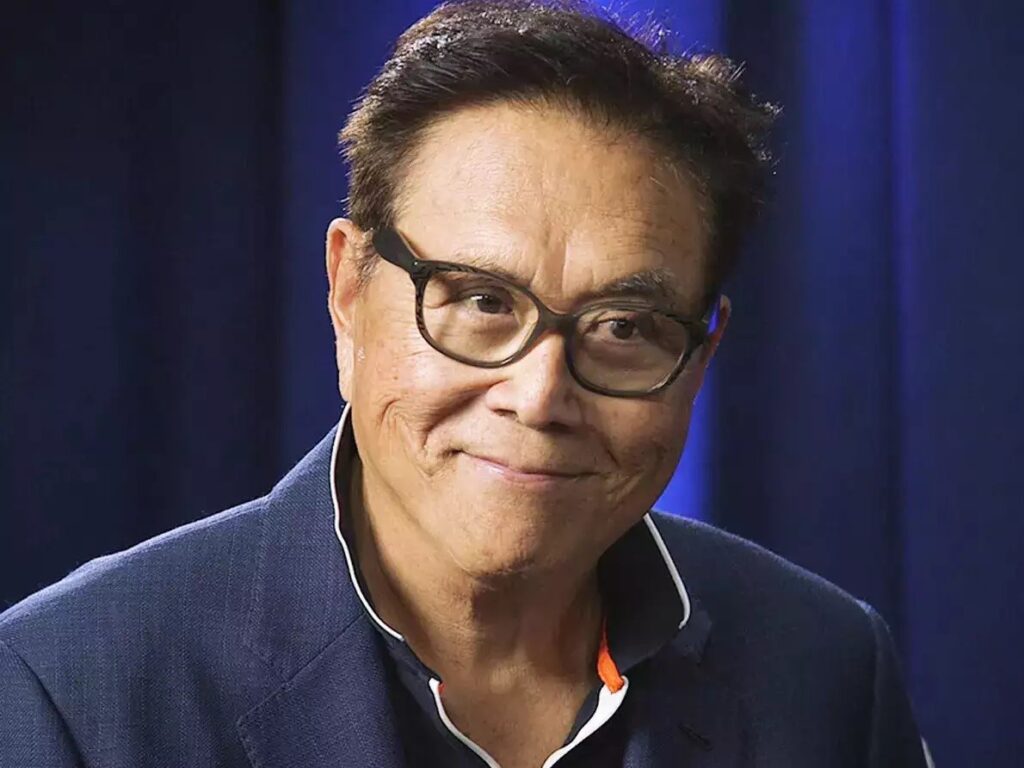

The author of Rich Dad, Poor Dad, Robert Kiyosaki, discusses his distinctive outlook on investing and debt. He views expensive cars as liabilities and utilizes debt to pay for assets. In addition, he believes that gold should be saved rather than cash and has accumulated a $1.2 billion debt.

Robert Kiyosaki, the author of Rich Dad, Poor Dad, recently offered a novel perspective on investments and debt that takes into account both assets and obligations. The best-selling author claimed that he utilizes loans to pay for assets on the social media site Instagram.

Kiyosaki went on to explain that his fully paid-off expensive cars, a Rolls-Royce and a Ferrari, are considered liabilities rather than assets.

Kiyosaki cast skepticism on the practice of storing currency in the reel, citing the US dollar’s 1971 departure from the gold standard under President Richard Nixon.

The author chooses to store gold instead of saving money by turning his profits into silver and gold.

It is freely acknowledged by Kiyosaki that he owes $1.2 billion as a result of this method. Because “if I go bust, the bank goes bust,” he claims he is in debt. Not a concern of mine.”

Robert went on to explain the source of the debt, stating that the funds had been utilized to purchase assets. Kiyosaki transformed his earnings into gold and silver and saved gold instead of cash. He stated this tactic was the reason behind the huge debt that was accumulated.

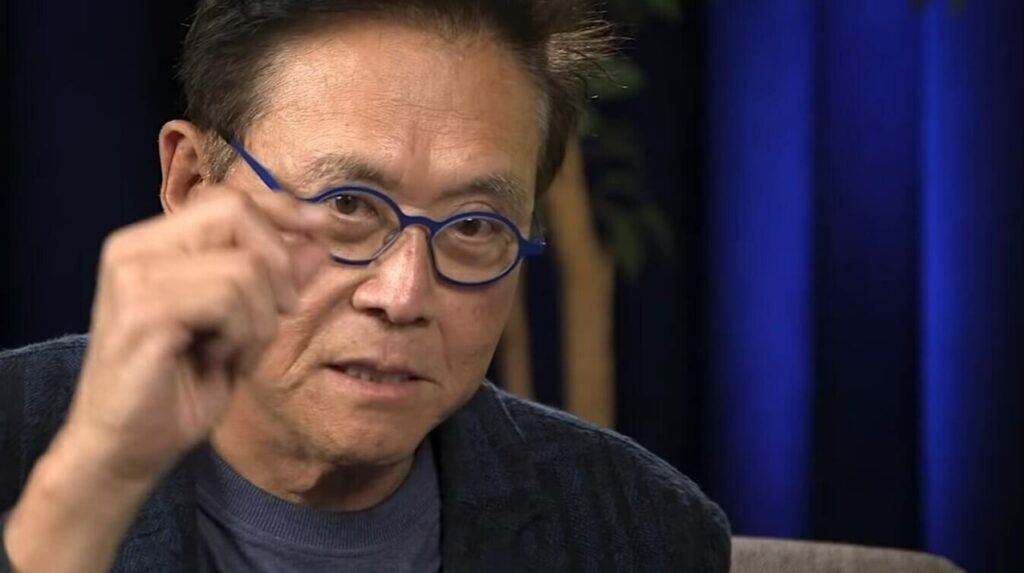

Kiyosaki’s Views on Good and Bad Debt

The kind of good debt that contributes to wealth accumulation includes loans taken out to buy assets that generate revenue, such as real estate, companies, or investments.

In particular, Kiyosaki supported the use of debt as leverage in real estate ventures, viewing it as a practical means of managing market volatility.

“I have no copper at all. I’m a big silver owner. I discovered a silver mine in Argentina, which was purchased by the Canadian mining company Yamana Gold. Kiyosaki stated, “I do own tons of gold and silver,” in a 2022 interview with Stockpulse at the Vancouver Resource Investment Conference.

Kiyosaki has always advocated for “real assets” such as Wagyu cattle, silver, gold, and bitcoin. He especially loves Bitcoin, which he views as a hedge against the US dollar’s declining value.

Because he simply doesn’t “trust the frickin’ dollar,” Kiyosaki considers currency to be “trash” and believes that gold is more secure and reliable.

A large portion of his investment approach also involves silver. He sees it as a long-term investment, especially considering how inexpensive it is in comparison to gold and how rare it is becoming.

His assets still revolve around real estate, which is prized for its ability to generate both capital appreciation and rental income.

His investments in Wagyu cattle are the most unusual. The best-selling author’s investment just confirms his opinion that there are better options than traditional investments.

Since its 1997 release, Robert Kiyosaki’s book “Rich Dad, Poor Dad” has sold over 40 million copies. In the book, Kiyosaki refuted the idea that accumulating large sums of money was the sole path to financial success and endorsed the benefits of prudent risk-taking and entrepreneurship.