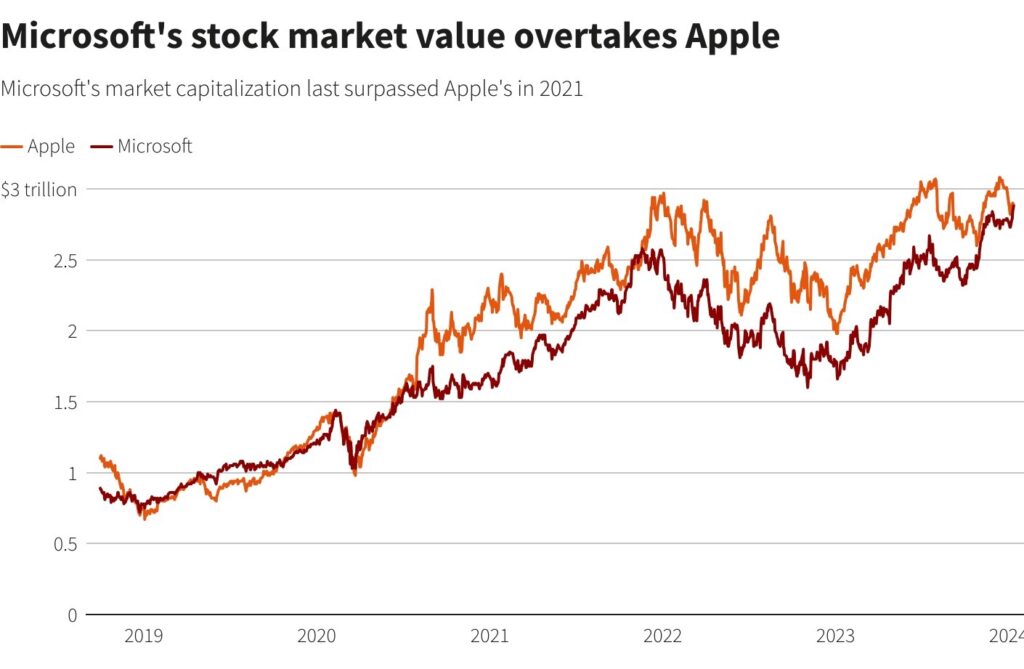

January 11 (Reuters) – For the first time since 2021, Microsoft (MSFT.O) briefly surpassed Apple (AAPL.O) as the most valuable corporation in the world on Thursday. This came after the iPhone maker’s shares had a poor start to the year due to mounting demand fears.

Because Microsoft invested in ChatGPT producer OpenAI and took an early lead in generative artificial intelligence, the company’s shares have increased significantly since last year.

Microsoft’s market valuation is $2.859 trillion after its stock closed 0.5% higher. It surged as much as 2% during the day and the firm was briefly worth $2.903 trillion.

After closing 0.3% lower, Apple’s market capitalization is at $2.886 trillion. Over the years, Apple and Microsoft have competed for the top position.

“Since Microsoft is growing faster and has more to gain from the generative AI revolution, it was inevitable that Microsoft would overtake Apple,” D.A. Davidson analyst Gil Luria stated.

Microsoft’s adoption of OpenAI’s technology throughout its productivity software line contributed to a growth in the company’s cloud computing division during the July–September quarter.

Conversely, Apple has been struggling with declining demand, particularly for its largest cash cow, the iPhone. As China’s economy slowly recovers from the epidemic and a resurgent Huawei (HWT.UL) eats away at its market share, demand in China, a significant market, has fallen.

Reducing Apple’s share price to “neutral,” brokerage Redburn Atlantic stated in a client letter on Wednesday that “China could be a drag on performance over the coming years.” Since the beginning of 2024, at least three of the 41 experts that follow Apple have downgraded their rankings.

On Friday, Apple increased by 0.2% while Microsoft gained 1%. According to LSEG data, Microsoft’s market capitalization reached its highest point ever at $2.887 trillion at that point. Apple’s market value, as determined by statistics in a filing on Thursday, was $2.875 trillion.

As of the most recent close, shares of Cupertino, California-based Apple had dropped 3.3%, while Microsoft’s shares had increased 1.8%. Based on a popular technique for assessing publicly traded companies, the share price-to-earnings (PE) ratio, both stocks are pricey.

LSEG data shows that Apple is trading at a forward PE of 28, significantly higher than its average of 19 over the previous ten years. Microsoft is trading above its 10-year average of 24 times forward earnings, at about 31 times.

Apple’s market value peaked on December 14 at $3.081 trillion, and its shares saw a 48% rise by year’s end. That was less than Microsoft’s reported 57% increase.

A few instances since 2018, Microsoft has momentarily surpassed Apple to become the world’s most valuable corporation. One such instance occurred in 2021 when the stock price of the iPhone maker was negatively impacted by supply chain constraints brought on by COVID-19.

Wall Street is currently more optimistic about Microsoft. Almost all brokerages covering the company recommend buying the stock, and the company has no “sell” recommendation.

Just two-thirds of the analysts that cover Apple rate it as a “buy,” while the business has two “sell” recommendations.

When comparing the prices of these tech stocks to their predicted earnings—a popular metric used to value publicly traded companies—they appear to be rather pricey. LSEG data shows that Apple is trading at a forward PE of 28, significantly higher than its average of 19 over the previous ten years. Microsoft is trading above its 10-year average of 24 times forward earnings, at about 32 times.

Due to the poor demand for iPads and wearables, Apple’s holiday quarter sales estimate for the quarter ended in November fell short of Wall Street’s forecasts in the company’s most recent quarterly report.

LSEG reports that analysts expect Apple to report revenue for the December quarter of $117.9 billion, up 0.7% on average. Its first sales growth year over year in four quarters would occur at that point. Apple releases their findings on Frb 1